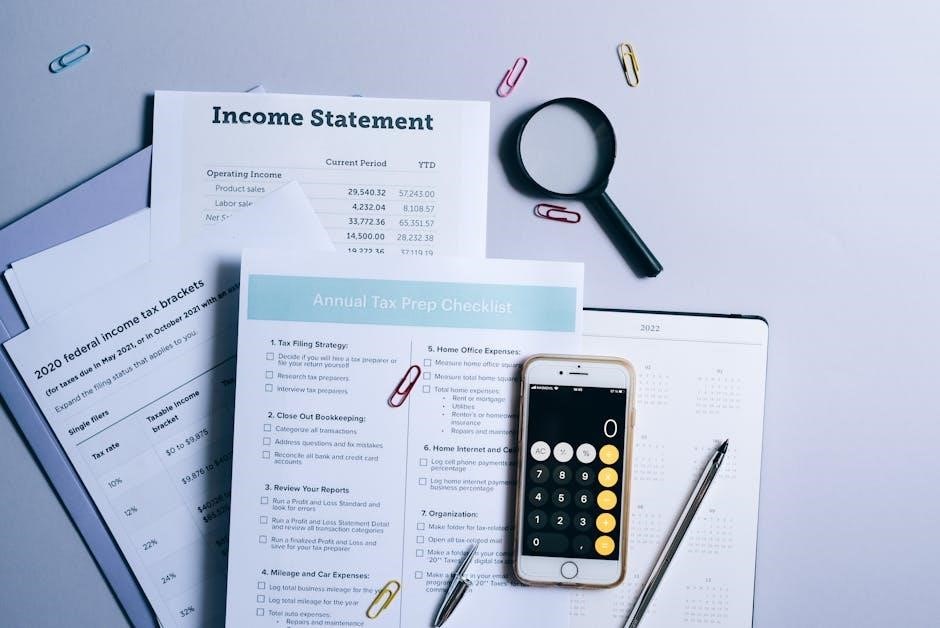

Small business tax deductions reduce taxable income‚ boosting profitability․ A checklist PDF helps identify eligible expenses‚ ensuring compliance and maximizing savings through organized expense tracking․

Understanding Tax Write-Offs for Small Businesses

Small business tax write-offs are expenses deducted from gross income to reduce taxable income․ Common examples include home office expenses‚ business use of a car‚ meals‚ travel‚ equipment‚ and professional fees․ These deductions must be ordinary and necessary for business operations․ A checklist helps identify eligible expenses‚ ensuring compliance with IRS guidelines․ Proper documentation is crucial to support claims․ Understanding what qualifies as a write-off is essential for maximizing savings․ This section provides a clear overview of how tax write-offs work‚ helping businesses navigate deductions effectively while adhering to tax laws․

Common Small Business Tax Deductions

Common deductions include home office expenses‚ business use of a car‚ meals‚ travel‚ equipment‚ supplies‚ and professional fees․ These deductions help reduce taxable income effectively․

Home Office Expenses

Home office expenses are deductible if the space is used regularly and exclusively for business․ This includes utilities‚ rent‚ and a portion of mortgage interest․

The Simplified Option allows a flat $5 per square foot deduction‚ up to $1‚500‚ simplifying record-keeping․

To qualify‚ the area must be the primary place of business or used for meeting clients․

A home office deduction can significantly reduce taxable income‚ but accurate documentation is essential to avoid IRS issues․

Ensure expenses are proportional to business use to comply with tax regulations․

- Utilities (electricity‚ water‚ internet)

- Rent or mortgage interest

- Home maintenance costs

Business Use of a Car

Deducting business use of a car involves calculating the percentage of time the vehicle is used for business purposes․

The standard mileage rate or actual expenses can be used․

Expenses include gas‚ maintenance‚ insurance‚ and parking fees․

Keep a mileage log to document business vs․ personal use․

The IRS requires accurate records to support the deduction․

This deduction can significantly reduce taxable income for small businesses․

Ensure the vehicle is owned or leased by the business to qualify․

Proper documentation is key to avoiding IRS scrutiny․

This deduction is a valuable tool for reducing tax liability․

- Gasoline and diesel expenses

- Vehicle maintenance and repairs

- Insurance premiums

- Parking and toll fees

Meals and Entertainment

Meals and entertainment expenses are partially deductible for small businesses․

The IRS allows a 50% deduction for business-related meals with clients or colleagues․

Entertainment expenses‚ like sporting events or concerts‚ are generally not deductible unless directly related to business discussions․

Meals must be substantiated with receipts and documentation of the business purpose․

Examples of deductible meals include client lunches or business dinners․

Non-deductible items include entertainment tickets or excessive meal costs․

Proper documentation is essential to comply with IRS rules․

This deduction helps reduce taxable income while fostering business relationships․

- Client lunches or dinners

- Business-related meals with colleagues

- Receipts and documentation required

Travel Expenses

Travel expenses for business purposes are tax-deductible‚ covering transportation‚ lodging‚ meals‚ and related costs․

Flights‚ trains‚ rental cars‚ and hotel stays qualify as deductible expenses․

Meals during travel are deductible at 50%‚ provided they are not extravagant․

Receipts and documentation are essential to substantiate these expenses․

Personal expenses during travel‚ such as sightseeing‚ are not deductible․

Proper records‚ including dates‚ destinations‚ and business purposes‚ must be maintained․

This deduction helps offset the costs of conducting business away from home․

- Transportation costs (flights‚ trains‚ rental cars)

- Lodging expenses (hotels‚ motels)

- Meals (50% deductible)

- Receipts and documentation required

Equipment and Supplies

Equipment and supplies used for business operations are tax-deductible․

This includes office supplies‚ computers‚ machinery‚ and tools․

Expenses for items used solely for business qualify for full deduction․

Items with a useful life over one year may require depreciation․

Section 179 allows immediate deduction of eligible equipment costs․

Receipts and records must detail purchase date‚ item‚ and cost․

This deduction helps reduce taxable income and lowers operational costs․

- Office supplies (stationery‚ software)

- Equipment (computers‚ machinery)

- Tools and materials

- Section 179 deduction for eligible items

Professional Fees

Professional fees paid for business-related services are tax-deductible․

These include fees for accountants‚ lawyers‚ and consultants․

Expenses for tax preparation‚ legal advice‚ and business consulting qualify․

Fees must be directly related to business operations or income generation․

Personal fees‚ such as individual tax preparation‚ are not deductible․

Records like invoices and payment receipts are required for verification․

This deduction helps small businesses offset costs for expert services․

- Accounting and tax preparation services

- Legal fees for business matters

- Consulting fees for business advice

Startup Costs and Organizational Expenses

Startup costs and organizational expenses are deductible‚ up to $5‚000 for startup and $5‚000 for organizational costs‚ reducing taxable income effectively․

Deducting Business Startup Costs

Startup costs are expenses incurred before your business begins operations․ These can include market research‚ legal fees‚ and business registration costs․ Up to $5‚000 of startup costs can be deducted in the first year‚ with any excess amortized over 15 years․ This deduction helps reduce taxable income‚ providing financial relief to new businesses․ Eligible costs may also include expenses related to setting up a business entity‚ such as LLC formation fees or partnership agreements․ Proper documentation is essential to claim these deductions accurately․ Always consult a tax professional to ensure compliance with IRS regulations and maximize your startup cost deductions effectively․

Organizational Costs for Legal Entities

Organizational costs refer to expenses incurred when forming a legal business entity‚ such as corporations or LLCs․ These costs‚ up to $5‚000‚ can be deducted in the first year‚ with any excess amortized over 15 years․ Examples include state filing fees‚ legal costs‚ and drafting partnership agreements․ Proper documentation ensures compliance with IRS guidelines․ These deductions help reduce taxable income‚ benefiting new businesses financially․ Consulting a tax professional is advisable to maximize deductions and ensure adherence to regulations‚ making it a crucial step in the initial setup of a legal entity for small businesses aiming to optimize their tax strategy effectively․

Section 179 Deduction

The Section 179 deduction allows businesses to deduct up to $1‚250‚000 of qualifying equipment‚ software‚ and property costs in the year of purchase‚ enhancing tax savings significantly․

Understanding the Section 179 Deduction

The Section 179 deduction enables businesses to deduct the full cost of qualifying equipment‚ software‚ and property in the year of purchase‚ up to $1‚250‚000 annually․ Unlike depreciation‚ which spreads deductions over years‚ Section 179 allows immediate tax savings․ Eligible assets include machinery‚ vehicles‚ and even certain building improvements․ This deduction is ideal for small businesses looking to invest in growth while reducing taxable income․ A checklist can help track purchases and ensure compliance with IRS guidelines‚ maximizing deductions and streamlining tax filings․ Proper documentation is crucial to avoid errors and ensure eligibility for this valuable tax benefit․

Limitations and Qualifying Property

The Section 179 deduction has specific limits and requirements․ For 2025‚ businesses can deduct up to $1‚250‚000 of qualifying property‚ with a spending cap of $2‚590‚000․ The deduction phases out dollar-for-dollar once purchases exceed this threshold․ Qualifying property includes tangible assets like machinery‚ equipment‚ vehicles‚ and certain software․ It also applies to qualified improvement property for non-residential buildings․ However‚ land‚ inventory‚ and certain intangible assets are excluded․ Businesses must use the property more than 50% for business purposes․ A checklist can help track eligible purchases and ensure compliance with IRS rules‚ avoiding common pitfalls like exceeding limits or claiming ineligible expenses․ Proper documentation is essential to validate deductions․

Section 199A Deduction

Section 199A allows pass-through entities to deduct 20% of qualified business income‚ reducing taxable income for eligible small businesses‚ including sole proprietorships and LLCs․

Pass-Through Entity Deduction

The Section 199A deduction provides a 20% tax deduction for pass-through entities‚ including sole proprietorships‚ S corporations‚ and partnerships․ This deduction applies to qualified business income‚ reducing taxable income․ Eligible businesses can claim this deduction‚ subject to income limits and phase-outs․ For example‚ in 2025‚ the deduction may be limited for high-income earners․ A checklist PDF can help track eligibility and ensure compliance․ Proper documentation‚ such as separating business and personal expenses‚ is crucial for accurate deduction calculation․ Consulting a tax professional is recommended to navigate complex rules and maximize benefits under this provision․

Calculating the 20% Qualified Business Income Deduction

To calculate the 20% Qualified Business Income (QBI) deduction‚ start by identifying net earnings from a qualified trade or business․ Subtract business-related expenses from total income to determine QBI․ Apply the 20% deduction to this amount‚ ensuring compliance with income thresholds that may limit or phase out the deduction․ Maintain accurate records to support eligibility and differentiate between personal and business expenses․ Stay informed about tax law updates and consider consulting a tax professional for complex situations․ This deduction can significantly reduce taxable income‚ enhancing business profitability when applied correctly․

How to Claim Small Business Tax Deductions

Organize expenses‚ maintain records‚ and use IRS forms to claim deductions․ A checklist PDF ensures accuracy‚ helping businesses comply with tax laws and maximize savings efficiently․

A Step-by-Step Guide to Claiming Deductions

To claim small business tax deductions‚ start by identifying eligible expenses using a checklist PDF; Organize records‚ including receipts and invoices‚ to support each deduction․ Next‚ review IRS forms like Form 1040‚ Schedule C‚ and other relevant schedules․ Calculate deductions accurately‚ ensuring compliance with tax laws․ Consult a tax professional to avoid errors and maximize savings․ Finally‚ submit your return by the deadline‚ ensuring all documentation aligns with IRS guidelines․ This structured approach simplifies the process and helps businesses claim deductions confidently while adhering to regulations․